Don't panic, the market's true main line is still liquidity

Original Author: @RaoulGMI

Translation: Peggy, BlockBeats

Editor's Note: When the market is in panic, liquidity tightens, and asset rotation stagnates, a bullish view often seems out of place. This article presents a contrarian perspective: if global liquidity remains the key macro variable driving everything, then the restart of the debt refinancing cycle may trigger the next round of a "liquidity flood." This is a game of time and patience—a starting point for growth may emerge after the "pain."

The following is the original text:

The Market's Main Plot

I know almost no one wants to hear a bullish view right now.

The market is in panic, and everyone is blaming each other. But the road to Valhalla is not far.

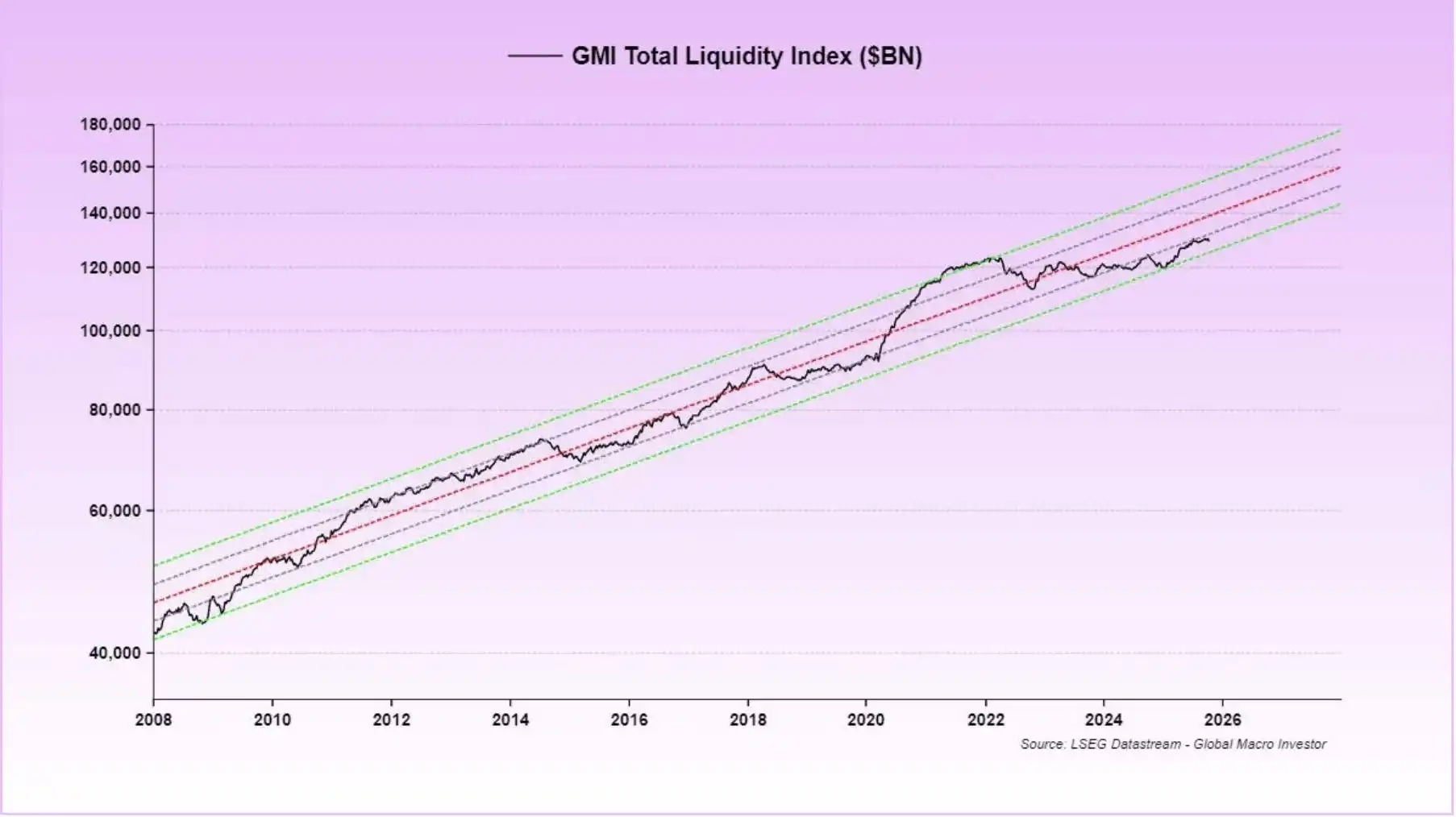

If global liquidity is the most decisive macro factor right now, then it is the only thing we should focus on.

Remember! The true main plot of the market now is the $100 trillion debt rollover. Everything else is a subplot. The game for the next 12 months revolves around this point.

Currently, due to the government shutdown, the Treasury General Account (TGA) is rapidly accumulating cash with nowhere to spend it, causing a sharp liquidity squeeze. This cannot be offset by reverse repos (as that portion of liquidity has already dried up), and quantitative tightening (QT) is further draining liquidity.

This has directly hit the market, especially the most liquidity-sensitive crypto assets.

The performance of traditional asset management institutions this year is generally lagging behind benchmarks, marking the worst performance in recent years. Now they have to passively "buy the dip," which paradoxically makes tech stocks more stable than crypto assets. Inflows from 401K funds have also provided some support.

However, if this liquidity dry-up persists longer, the stock market will also find it hard to escape a downturn.

However, once the government shutdown ends, the U.S. Treasury will disburse $250-350 billion within a few months, and quantitative tightening will stop, nominally expanding the balance sheet again.

With the return of liquidity, the dollar may weaken again.

The tariff negotiations will also come to an end, gradually reducing policy uncertainty.

At the same time, the continuous issuance of treasuries will inject more liquidity into the market through banks, money market funds, and even the stablecoin system.

Next, the interest rate will continue to be lowered. The economic slowdown caused by the shutdown will be used as a reason for the rate cut—but this does not mean an economic recession.

On the regulatory front, the SLR (Supplementary Leverage Ratio) adjustment will release more bank balance sheet space, supporting credit expansion.

The "CLARITY Act" is also expected to pass, providing a much-needed regulatory framework for banks, asset management firms, and businesses to adopt encrypted assets on a large scale.

Meanwhile, the "Big Beautiful Bill" will further boost the economy, setting the stage for strong growth leading up to the 2026 midterm elections.

The entire system is restructuring towards one goal: a robust economy and thriving market in 2026.

Meanwhile, China will continue to expand its balance sheet, Japan will work to support the yen and introduce fiscal stimulus.

With interest rates falling and tariff uncertainty dissipating, U.S. manufacturing activity (ISM index) will also rebound.

So, the key now is to weather this "Window of Pain."

At the other end of it is a "Liquidity Flood."

Always remember that old rule: Don't mess it up.

Be patient, endure the volatility.

Such pullbacks are not uncommon in a bull market, and their purpose is to test your conviction.

If you have the capacity, take advantage of the dip.

TD;DR (Too Delighted; Didn't Rejoice)

When this number (liquidity index) rises, all other numbers will rise with it.

You may also like

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Acquires 18,333,334 qONE Tokens

Key Takeaways HYLQ Strategy Corp has made a strategic investment in qLABS, purchasing over 18 million qONE tokens…

WLFI Crypto Surges Toward $0.12 as Whale Purchase Precedes Trump-Linked Forum

Key Takeaways Whale accumulation has spurred a rally in WLFI crypto prices, reaching towards $0.12 ahead of a…

Cathie Wood Reverses Path with $6.9 Million Purchase in Coinbase Stock – Is ARK Strategizing a Rebound?

Key Takeaways ARK Invest acquires 41,453 shares of Coinbase, showing renewed interest post recent divestment. This acquisition by…

Crypto Lobby Establishes Working Group to Advocate for Prediction Market Regulatory Clarity

Key Takeaways The Digital Chamber announced the Prediction Markets Working Group to promote federal oversight of prediction markets.…

Peter Thiel Discreetly Withdraws from Ethereum Treasury Venture ETHZilla – A Cautionary Note for the DAT Model?

Key Takeaways Peter Thiel and Founders Fund have completely exited their position in ETHZilla. Thiel’s withdrawal raises questions…

Coin Center Advocates Protecting Crypto Developer Liability

Key Takeaways Coin Center is actively lobbying the U.S. Senate to safeguard crypto developer liability protections. The ongoing…

$150B in US Tax Refunds Could Catalyze Fresh Crypto Inflows, Historical Trends Indicate

Key Takeaways The IRS anticipates distributing approximately $150 billion in tax refunds to U.S. consumers by the end…

Oracle Error Leads DeFi Lender Moonwell to $1.8 Million in Bad Debt

Key Takeaways A critical oracle pricing glitch caused Moonwell to incur nearly $1.8 million in bad debt. The…

Crypto Price Prediction Today 18 February – XRP, Solana, Dogecoin

Key Takeaways XRP targets a $5 move, driven by its role as an alternative to SWIFT for cross-border…

China’s DeepSeek AI Predicts the Price of XRP, PEPE, and Shiba Inu By the End of 2026

Key Takeaways DeepSeek AI suggests significant potential price increases for XRP, PEPE, and Shiba Inu by 2026. XRP…

XRP Battles Key Support Amid Grayscale Sentiment Surge

Key Takeaways XRP has experienced a 29% price drop recently, creating a tense atmosphere among traders eyeing key…

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…