What Is Warden (WARD) Token? Warden (WARD) Token Price 2026

Warden (WARD) Token has rapidly emerged as a significant player in the converging worlds of artificial intelligence and decentralized finance. As the native utility token powering Warden Protocol's innovative "Global Agent Network," Warden Protocol (WARD) represents more than just another cryptocurrency—it's the economic backbone of infrastructure designed specifically for secure AI agent operations across blockchain ecosystems. This comprehensive 2026 analysis examines everything potential investors need to know, including detailed Warden (WARD) Token price prediction models, complete tokenomics breakdown, and practical guidance on how to buy Warden Protocol (WARD) through leading exchanges.

What Is Warden (WARD) Token?

The fundamental question for any investor considering this asset is precisely what is Warden (WARD) Token and what technological innovation does it represent? Warden Protocol addresses one of the most significant challenges in today's blockchain landscape: how to safely integrate artificial intelligence capabilities while maintaining security, transparency, and user control. Unlike projects that simply add AI features as peripheral components, Warden was architected from inception as a specialized Layer 1 blockchain built on Cosmos SDK, creating a dedicated environment where AI agents can execute complex operations autonomously yet verifiably.

At its technological core, Warden Protocol (WARD) implements several groundbreaking systems that differentiate it from conventional approaches to AI-blockchain integration. The protocol's programmable permission framework allows precise definition of what actions AI agents can perform, which assets they can access, and under what conditions they can operate—addressing the fundamental security dilemma of granting autonomy while preventing unauthorized activities. Complementing this is the Statistical Proof of Execution (SPEx) system, which uses innovative sampling methods to verify agent behavior efficiently at scale, balancing thorough verification with practical performance considerations.

Read More: Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

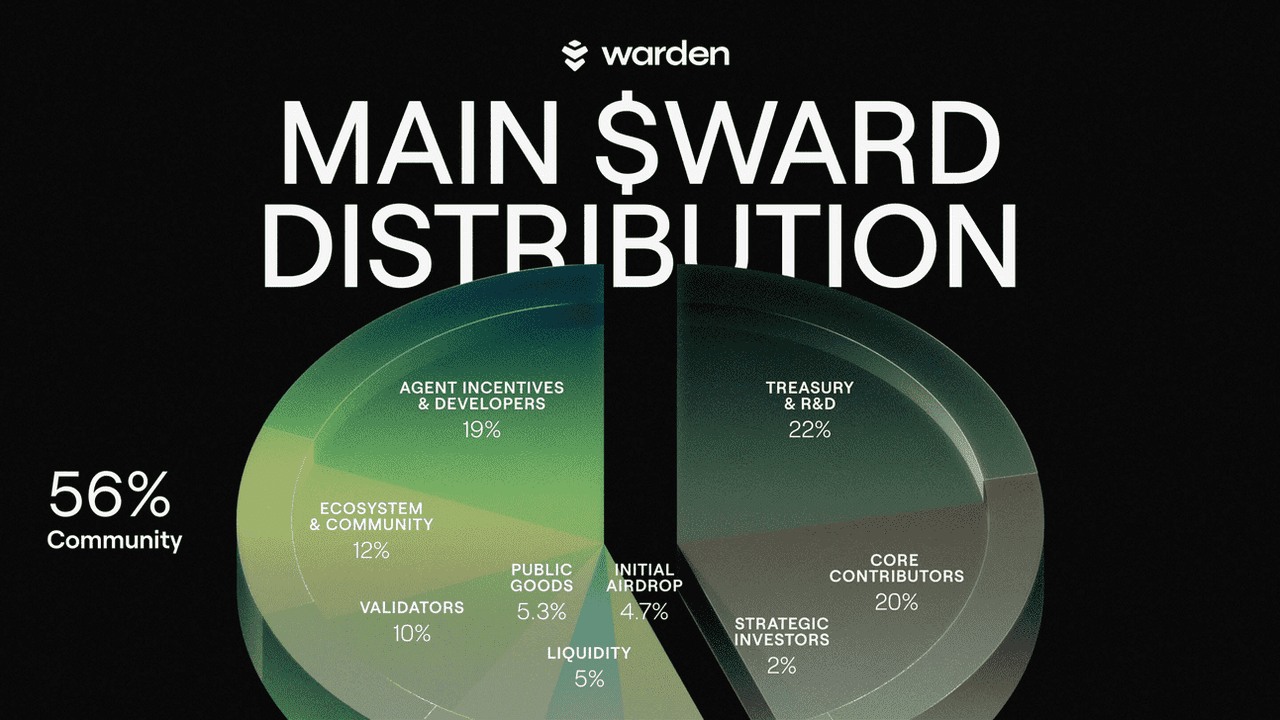

Warden Protocol (WARD) Tokenomics

WARD is the native utility token of the Warden Protocol ecosystem, designed to support secure, cross-chain AI agent execution and on-chain verification. It aligns incentives across developers, validators, users, and infrastructure providers while ensuring long-term sustainability of the Global Agent Network. WARD serves as the core payment, staking, and governance asset within the protocol.

Warden Protocol (WARD) Token Details

- Token Ticker: WARD

- Total Supply: 1,000,000,000 WARD (fixed supply)

- Token Launch: January 2026

- Supply Model: Controlled release with vesting; capped supply, with adjustable inflation targeting 8% annually at launch

Warden Protocol (WARD) Token Distribution

- Initial Airdrop (4.70%): 47 million WARD allocated to reward early community members. 30.32 million tokens were released at the network launch (genesis), with the remaining balance unlocking gradually over a 6-month period.

- Public Goods (5.30%): Dedicated to user incentives and activity-based rewards. 10 million tokens were available at launch, with the rest scheduled to vest over 30 months.

- Ecosystem & Community (12.00%): Funds ecosystem growth, including marketing, partnerships, events, and infrastructure development. 20 million tokens were unlocked at genesis; the remainder vests over 30 months.

- Liquidity (5.00%): 50 million tokens are fully allocated and unlocked to support exchange listings and ensure healthy market-making from the start.

- Agent Incentives & Developers (19.00%): Reserved for grants and rewards to developers who build and deploy AI agents and applications. 20 million tokens are available immediately, with the rest vesting linearly over 12 months.

- Validators (10.00%): 100 million tokens are permanently delegated to network validators to secure the protocol and are not part of the circulating supply.

- Treasury & R&D (22.00%): Funds ongoing operations, research, development, and future strategic initiatives. 120 million tokens were unlocked at launch, with an additional 100 million vesting over the following 12 months.

- Strategic Investors (2.00%): Allocated to participants in the 2026 strategic funding round. These tokens are subject to a 12-month lock-up period, followed by linear release over the next 12 months.

- Core Contributors (20.00%): Reserved for the founding team and advisors. This allocation has a 6-month initial lock-up, after which tokens vest linearly over 2 years.

Warden Protocol (WARD) Token Utilities

- Agent Execution Fees: WARD tokens are used to pay for all services involving AI agents, including computation, verification, and cross-chain operations.

- On-Chain Verification (SPEx): The token is required to pay for the Statistical Proof of Execution service, which provides verifiable, on-chain auditing of AI agent behavior.

- Publishing & Upgrades: Developers must use WARD to publish, update, or register new AI agents and reusable modules within the Warden ecosystem.

- Staking & Network Security: Token holders can stake WARD to help secure the network as validators or delegators, earning rewards in return.

- Ecosystem Access & Premium Features: Holding WARD may grant access to advanced agent services, higher usage tiers, and exclusive features within Warden applications.

- Governance (Future): WARD is designed to evolve into a governance token, allowing holders to vote on protocol upgrades, funding proposals, and key ecosystem parameters.

Warden (WARD) Token Price Prediction 2026

Developing an accurate Warden (WARD) Token price prediction for 2026 requires examining both technical chart patterns and fundamental adoption metrics within the broader context of AI-blockchain sector growth. As of February 2026, WARD token trades at approximately $0.1073 with a market capitalization of $27.6 million, reflecting the project's early-stage position within a rapidly evolving technological niche.

Chart analysis reveals several significant price levels that have demonstrated importance in recent trading activity. The $0.085-$0.095 range has shown resilience as primary support during distribution-related selling pressure, while the $0.120-$0.130 zone represents immediate resistance that must be overcome for sustained upward movement. Longer-term technical patterns suggest that breakthrough above the $0.150-$0.170 resistance cluster could initiate more significant price discovery as the token establishes itself beyond initial distribution phases.

Fundamental Valuation Framework:

Three primary scenarios emerge when constructing a comprehensive Warden (WARD) Token price prediction for 2026:

- Conservative Scenario ($0.15-$0.25): This outlook assumes steady but measured protocol adoption, moderate expansion to additional exchanges, and continued sector-wide growth in AI-related blockchain applications without major breakthrough partnerships or explosive user adoption metrics.

- Moderate Scenario ($0.30-$0.50): This more optimistic projection incorporates successful integration with established AI development platforms, listing on additional tier-1 exchanges, growing adoption among Web3 developers, and execution of current roadmap milestones without significant technical hurdles.

- Bullish Scenario ($0.75-$1.20): The most optimistic outlook envisions mass adoption of AI agents within DeFi applications, strategic partnerships with major Web3 infrastructure projects, growing institutional recognition, and Warden Protocol establishing itself as standard infrastructure for on-chain AI operations.

How to Buy Warden Protocol (WARD) 2026

For those proceeding after evaluating the risks, knowing how to buy WARD crypto safely is essential. The primary route is through WEEX Exchange.

Step-by-Step Guide: Buying PENGUIN on WEEX Exchange

Step 1: Create and Verify Your WEEX Account

- Visit the official WEEX website or download the mobile app.

- Click “Sign Up” and register using your email or phone number.

- Verify your email through the confirmation link.

- Complete KYC verification to unlock higher limits and enhanced security.

Step 2: Deposit Funds

Navigate to “Assets” → “Deposit” and select your preferred method:

- Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.

- Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX address.

Step 3: Execute Your Purchase

WEEX offers three primary methods to buy Bitcoin:

Method 1: Instant Buy (Recommended for Beginners)

- Go to “Buy Crypto” → “Quick Buy”.

- Select Warden Protocol (WARD) and your fiat currency.

- Enter the amount and choose the payment method.

- Review and confirm. Bitcoin will be delivered to your spot wallet instantly.

Method 2: Spot Trading (For Advanced Control)

- Navigate to “Trade” → “Spot”.

- Search for WARD/USDT.

- Choose order type: Market Order or Limit Order

- Enter amount and execute trade.

Can I Invest in Warden Protocol (WARD)?

Several developments could serve as significant positive catalysts for Warden (WARD) Token valuation throughout 2026. Additional listings on major centralized exchanges would dramatically improve accessibility and liquidity, potentially attracting institutional interest and expanding the investor base. Successful integration with established AI development platforms could accelerate adoption by making Warden's infrastructure more accessible to the broader AI developer community. Major protocol partnerships, particularly with prominent DeFi platforms or cross-chain infrastructure projects, would validate Warden's technical approach while expanding its potential user base.

Perhaps most fundamentally, measurable growth in active AI agents operating on the network and increases in protocol-generated revenue would provide concrete validation of Warden's value proposition. As the AI agent economy matures throughout 2026, Warden Protocol's specialized infrastructure position could become increasingly valuable, particularly if it establishes itself as the preferred platform for secure, verifiable AI operations on blockchain.

Comparative Analysis: Warden (WARD) vs. Other AI-Focused Cryptocurrencies

Understanding Warden (WARD) Token positioning within the broader landscape of AI-related cryptocurrencies provides valuable context for investment decision-making. Unlike more generalized AI platforms like Fetch.ai (offering broad AI services) or SingularityNET (functioning primarily as an AI marketplace), Warden Protocol specializes specifically in infrastructure for secure AI agent operations. This focused approach creates different risk-reward characteristics and competitive dynamics compared to projects with broader mandates.

Render Token (RNDR), with its significantly larger market capitalization, addresses the different but adjacent problem of decentralized GPU rendering for AI training and inference. The two projects could potentially become complementary rather than directly competitive, as sophisticated AI agents operating on Warden might utilize decentralized computing resources from networks like Render. Bittensor (TAO) takes yet another approach, creating a decentralized network for machine learning model training and evaluation.

WARD token's relatively modest current market capitalization compared to these established projects reflects both its earlier development stage and more specialized focus. This positioning offers potentially greater percentage upside if Warden successfully establishes itself as the standard infrastructure for AI agents on blockchain, but also implies higher volatility and potentially greater vulnerability to competitive pressures as the sector matures.

Warden Protocol Roadmap and Ecosystem Expansion

Warden Protocol's development trajectory throughout 2026 focuses on several key areas that could significantly influence WARD token valuation and ecosystem growth. Protocol upgrades currently in development aim to enhance performance metrics, expand cross-chain interoperability capabilities, and implement more sophisticated governance mechanisms that progressively decentralize protocol control.

Ecosystem expansion initiatives prioritize developer onboarding through improved tooling, documentation, and incentive structures aimed at accelerating creation of diverse AI agent applications. Partnership development strategies seek collaboration with established projects across DeFi, gaming, enterprise blockchain, and traditional AI sectors to expand use cases and user adoption.

Longer-term vision positions Warden Protocol as potential standard infrastructure for on-chain AI operations, creating a multi-chain ecosystem supporting diverse AI-powered applications while establishing comprehensive security frameworks that make autonomous AI operations routine rather than exceptional in blockchain environments. Success in these development areas throughout 2026 will likely correlate strongly with Warden (WARD) Token valuation as utility and adoption metrics grow.

Conclusion: Can I Invest in Warden Protocol (WARD)?

The Warden (WARD) Token represents a forward-looking opportunity at the intersection of AI and decentralized blockchain infrastructure. While its price path in 2026 carries both high potential and inherent volatility, the project's specialized focus offers a compelling case for informed investors with a long-term perspective.

For those ready to explore this and other emerging digital assets, WEEX provides a secure, user-friendly platform to register and trade cryptocurrencies with confidence. Benefit from competitive fees, deep liquidity, and a reliable trading environment designed for both new and experienced participants.

Begin your journey today by signing up on WEEX and accessing the evolving world of crypto with clarity and security.

Further Reading

- Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

- Which Crypto Will Go 1000x in 2026?

- Where to Buy Usor Crypto in 2026? Step-by-Step Guide for Beginners

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

You may also like

Did AI Create Moltbook? Exploring the Origins of This Buzzworthy AI Social Network and Its Crypto Token

Moltbook burst onto the scene in late January 2026, captivating the tech and crypto worlds with its unique…

Moltbook Release Date: Key Details on the Launch, Price Trends, and What’s Next for MOLT

Moltbook burst onto the scene in late January 2026, capturing attention in the crypto world with its unique…

What is x402guard (X40G) Coin?

We are thrilled to announce that x402guard (X40G) has been newly listed on WEEX, with trading initiated on…

X40G USDT Premieres on WEEX: x402guard (X40G) Coin World Debut

WEEX Exchange is thrilled to announce the world premiere listing of x402guard (X40G) Coin, bringing this innovative token…

Moltbook (MOLT) Crypto Price Prediction & Forecasts for February 2026: Analyzing the Sharp 40% Drop and Recovery Potential

Moltbook (MOLT) has been turning heads in the crypto space as a unique social network designed for AI…

x402guard (X40G) Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally in Sci-Fi Themed Crypto

The x402guard (X40G) Coin has just hit the market with its trading debut on WEEX Exchange today, February…

What Is Zama (ZAMA)? Zama (ZAMA) Price Prediction

Zama (ZAMA) addresses this fundamental limitation by introducing Fully Homomorphic Encryption to blockchain technology. Unlike conventional encryption methods that require data to be decrypted before processing, FHE allows computations to be performed directly on encrypted data. This breakthrough means that smart contracts can validate conditions, execute logic, and produce results without ever accessing the actual sensitive information involved in the transaction.

How WEEX Hackathon's Top AI Strategies Thrived in Volatile Live Crypto Markets (AMA Recap)

How did AI trading strategies survive real crypto market stress? The WEEX AMA recap breaks down multi-agent systems and live risk management.

Bitcoin Price Falls Below $67,000: Will Bitcoin Rebound or Keep Falling? Bitcoin Price Prediction 2026

Bitcoin has experienced a significant correction in early 2026, dropping approximately 20% in a single week and approaching levels not seen since late 2024. This decline from October 2024's $126,000 highs represents nearly a 50% reduction in value, triggering widespread discussion about whether this correction represents a healthy market reset or signals deeper fundamental issues.

首个Gifts新模式代币税给创始人 (GIFTS) Coin Price Prediction & Forecasts for February 2026 – Potential Rally Ahead?

The 首个Gifts新模式代币税给创始人 (GIFTS) Coin has just made its debut on the crypto scene, stemming from a viral Twitter…

Incentiv (CENT) Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally

Incentiv (CENT) Coin has just hit the spotlight with its listing on exchanges like WEEX, where CENT/USDT trading…

The Toilet (TOILET) Coin Price Prediction & Forecasts for February 2026: Could This Meme Token Surge Amid Solana’s Momentum?

As a seasoned crypto trader who’s been navigating the ups and downs of the market since the early…

Bitelions (BTL) Coin Price Prediction & Forecast February 2026: Up 3.9% Amid New Listing – Can It Sustain the Rally?

Bitelions (BTL) has just made waves with its fresh listing on major exchanges, including trading going live on…

The Big Trout (BIGTROUT) Coin Price Prediction & Forecasts for February 2026 – Could It Surge 50% Amid On-Chain Hype?

The Big Trout (BIGTROUT) Coin has just hit the spotlight with its listing on WEEX Exchange today, February…

Gold at $5,000: Is PAXG Still a Buy? 2026 Price Prediction and the “Sovereign Debt Apex” Explained

Gold has surged past the $5,000 mark recently, driven by global economic pressures and investor flight to safe-haven…

The $320 Trillion Global Pivot: Why PAXG is the Ultimate “Exit Strategy” from the Traditional Banking System in 2026

As global debt hits a staggering $320 trillion, economies worldwide grapple with instability, pushing investors toward reliable alternatives.…

Beyond HODLing: 3 Professional Strategies to Earn Yield on Your Gold with PAXG in 2026

As we move into 2026, PAX Gold (PAXG) continues to stand out in the crypto space by bridging…

PAXG vs. Gold ETFs: Why 24/7 Instant Liquidity is Killing the Traditional “Paper Gold” Market in 2026

As we move deeper into 2026, the gold investment landscape has shifted dramatically, with tokenized assets like PAX…

Did AI Create Moltbook? Exploring the Origins of This Buzzworthy AI Social Network and Its Crypto Token

Moltbook burst onto the scene in late January 2026, captivating the tech and crypto worlds with its unique…

Moltbook Release Date: Key Details on the Launch, Price Trends, and What’s Next for MOLT

Moltbook burst onto the scene in late January 2026, capturing attention in the crypto world with its unique…

What is x402guard (X40G) Coin?

We are thrilled to announce that x402guard (X40G) has been newly listed on WEEX, with trading initiated on…

X40G USDT Premieres on WEEX: x402guard (X40G) Coin World Debut

WEEX Exchange is thrilled to announce the world premiere listing of x402guard (X40G) Coin, bringing this innovative token…

Moltbook (MOLT) Crypto Price Prediction & Forecasts for February 2026: Analyzing the Sharp 40% Drop and Recovery Potential

Moltbook (MOLT) has been turning heads in the crypto space as a unique social network designed for AI…

x402guard (X40G) Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally in Sci-Fi Themed Crypto

The x402guard (X40G) Coin has just hit the market with its trading debut on WEEX Exchange today, February…

Earn

Earn